What if one digital tool could speed up real estate deals, protect sensitive documents, and help your team work smarter — all at once?

In the high-pressure world of real estate, efficiency and security aren’t just goals — they’re requirements. From acquisitions to asset sales, the volume of documentation and the need for compliance have never been greater. That’s why more companies are turning to the real estate data room, a secure, cloud-based platform designed to simplify complex transactions.

Whether you’re in commercial real estate, managing portfolios, or leading due diligence on a major deal, a data room offers the structure, transparency, and protection your team needs. In this article, you’ll discover how real estate data rooms work, the features that matter most, and why they’re becoming essential tools for modern real estate professionals.

Ready to bring order to the chaos of real estate transactions? Let’s dive in.

Introduction to Data Rooms

A virtual data room (VDR) is a secure online workspace designed for storing, managing, and sharing confidential documents. In the real estate industry, this platform is particularly crucial for facilitating due diligence, investment analysis, and collaboration during property transactions. It also enhances the overall client experience by enabling secure document sharing and communication.

A real estate data room provides centralized access to documents such as title deeds, zoning information, tenant records, and financial statements. It enables key stakeholders—such as investors, developers, brokers, and legal teams—to collaborate securely, saving time and reducing risk. Effective communication tools within the VDR enhance collaboration and workflow during property transactions. With the global virtual data room market projected to surpass $3 billion by 2025, demand continues to grow across sectors like commercial real estate and real estate investment trusts (REITs).

Flexible and Efficient Property Management

A major benefit of utilizing a real estate data room for secure and efficient property management is the ability to manage assets remotely, enabling flexible work schedules and seamless coordination between teams. The platform supports bulk actions, allowing asset managers to make large-scale changes efficiently, such as scheduling security policy changes in advance. Advanced document controls, version tracking, and automated updates help teams stay aligned on key property and transaction details.

Portfolio management is crucial in streamlining the entire asset lifecycle. Centralizing document management and communication ensures efficiency and transparency for real estate transactions, enhancing collaboration among stakeholders and facilitating comprehensive oversight of multiple portfolio assets.

Key Features:

- Clear access protocols and user permissions

- Mobile and desktop access for remote collaboration

- Real-time data tracking and status updates

- Secure storage for asset-level documentation

This adaptability ensures asset managers and analysts can work efficiently from any location, while maintaining control over critical data and compliance standards.

Why Real Estate Professionals Rely on Data Rooms

Save Time, Minimize Risk, and Centralize Processes

Professionals in commercial real estate services are under increasing pressure to deliver fast, data-driven results. A commercial real estate data room addresses this challenge by consolidating complex information into a centralized, secure environment, streamlining the diligence process.

A secure virtual data room is crucial in the due diligence process, as it organizes and provides easy access to essential documents, fostering communication among stakeholders and enhancing investor confidence with efficiently managed information.

Top benefits include:

- Granular Permissions: Limit access by user role to protect sensitive data

- Bulk Uploads: Quickly add thousands of files and organize them automatically

- Audit Trails: Track every action for legal transparency and compliance

- Q&A Tools: Communicate directly within the data room for faster resolutions

In high-stakes transactions, having everything in one place accelerates due diligence and supports informed decision-making.

Data Analytics in Real Estate Transactions

Today’s real estate data providers offer more than storage—they also provide actionable insights. With integrated analytics, VDRs support informed decision-making by providing:

- Real-time document view reports

- Investor activity tracking

- Deal interest metrics and trends

These insights are invaluable during negotiations or capital raising, helping sellers and advisors understand investor behavior and fine-tune their strategy.

Using a market data approach to real estate, stakeholders can compare asset value, evaluate investment potential, and track real estate market trends using secure, centralized tools.

Commercial Real Estate Applications

In the realm of commercial real estate, virtual data rooms have become indispensable tools for managing complex transactions such as acquisitions, dispositions, and fundraising processes. These platforms provide a secure and efficient way to handle and share real estate documents, ensuring both confidentiality and integrity throughout the transaction lifecycle.

Commercial real estate professionals—including owners, brokers, lenders, and equity partners—rely on virtual data rooms to streamline their operations. By offering a centralized platform for managing real estate projects, these data rooms enable secure document sharing and collaboration among all parties involved. This not only enhances efficiency but also reduces the risk associated with handling sensitive information.

The adoption of virtual data rooms in commercial real estate applications has surged, with many companies recognizing the benefits of this technology. These platforms provide a secure and compliant way to manage confidential documents and legal documents, ensuring that sensitive information is protected at all times.

Key Features:

- Granular Permissions and Access Controls: Users can manage permissions to ensure that only authorized parties can access sensitive information.

- Detailed Reports and Activity Monitoring: Track user activity and document views to maintain transparency and accountability.

- Secure Document Sharing: Facilitate efficient and secure sharing of documents among stakeholders.

By leveraging virtual data rooms, real estate professionals can manage their transactions more effectively, ensuring that all parties involved have access to the essential information they need while maintaining the highest standards of security and compliance.

This approach ensures that the new sections are informative, aligned with the existing content, and optimized for search engines.

Real Estate Data Room Checklist

To make the most of your data room solution, responsible managers should follow a checklist that ensures all critical aspects of a transaction are covered:

- Upload and categorize all relevant documentation

- Set up granular user access permissions

- Enable multi-factor authentication and watermarking

- Use activity monitoring tools to track investor engagement

- Regularly update and audit document versions to keep them up to date

This proactive approach not only saves time but also demonstrates transparency and professionalism to potential investors and buyers.

Security and Compliance Standards

In a heavily regulated industry, protecting confidential information is non-negotiable. A top-tier real estate investment data room must meet the highest standards of data protection and regulatory compliance. This includes:

- Bank-grade encryption

- Two-factor authentication

- Compliance with GDPR, HIPAA, and other regulations

- Role-based access controls

These features give real estate professionals peace of mind, ensuring that sensitive information remains protected throughout the transaction lifecycle.

Document Management and Workflow Automation

Document-heavy processes are unavoidable in commercial real estate, but with the right VDR, they become significantly more manageable by allowing asset managers to perform bulk actions efficiently.

VDRs offer:

- Smart indexing and search functionality

- Version control and document expiration

- Watermarking and download restrictions

- Collaborative review tools with time-stamped comments

Effective portfolio management is crucial for streamlining the entire asset lifecycle. Centralizing document management and communication ensures efficiency and transparency for real estate transactions, enhancing collaboration among stakeholders and facilitating comprehensive oversight of multiple portfolio assets.

This structured system enhances efficiency, especially during high-volume portfolio transactions.

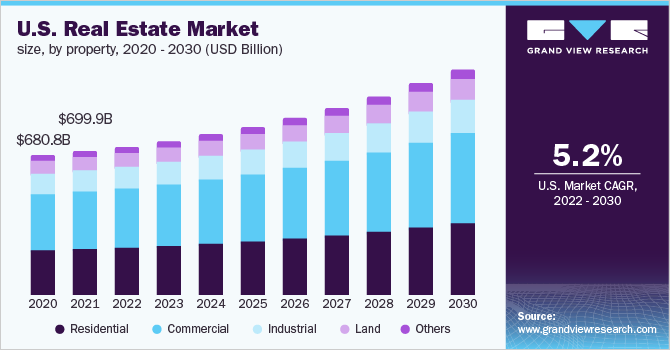

U.S. Real Estate Market Trends in 2025

The U.S. real estate market continues to evolve in response to economic and environmental pressures. Understanding these trends is crucial for professionals using data rooms to facilitate smooth and successful property transactions, including those involving venture capital.

Data rooms are also essential for managing private equity transactions, ensuring secure document management and facilitating negotiations during the investment process.

- Slower Home Price Growth: Despite continued growth, rising mortgage rates (averaging 6.5%) are cooling the market. The national average home value reached $361,263 as of early 2025. (Zillow, Forbes)

- Climate Risks Impacting Values: Areas like southwest Florida face potential declines in property value (20–40%) due to increasing insurance premiums and environmental risks. (The Times)

- Changing Buyer Preferences: Millennial and Gen Z buyers are shifting demand toward move-in-ready homes and multigenerational housing. (Kiplinger, BHG)

- Policy-Driven Developments: Government incentives for affordable housing and zoning reforms are shaping development strategies. (House Beautiful)

For those operating in or investing in the U.S. real estate market, a virtual data room is indispensable for managing sensitive data, organizing due diligence documentation, and supporting deal readiness in a dynamic landscape.

Final Thoughts

The modern real estate environment demands tools that offer security, efficiency, and clarity—especially when navigating the complex workflows of commercial real estate transactions. A real estate data room delivers all of this and more, enabling teams to collaborate safely, manage portfolios effectively, and keep pace with a rapidly shifting real estate market. Virtual data room solutions are essential for securely sharing and managing sensitive information among various stakeholders.

A Real Estate Investment Trust (REIT) plays a crucial role in managing complex commercial real estate transactions, emphasizing the need for secure document sharing and efficient organization of materials.

Whether you’re preparing for a property acquisition, managing a REIT, or navigating multi-asset sales, adopting a secure and intelligent VDR is no longer a luxury—it’s a necessity.